The $97 Course That Makes You Smarter

Than 99% of People About IULs

Stop letting financial jargon and confusing policies rob you of peace of mind. In just

4.5 hours, this course gives you the clarity and confidence to make IULs work for you

—not against you.

Stop letting financial jargon and confusing policies rob you of peace of mind. In just 4.5 hours, this course gives you the clarity and confidence to make IULs work for you

—not against you.

30-Day Money-Back Guarantee

Real Client Case Studies

Real Client Case Studies

Real Client Case Studies

Learn about this Powerful Tool

In this video you will learn how to use the tax code to supercharge your retirement savings.

Don't Just Take Our Word For It...

Hear from a client who was just as confused as you are now:

The video and explanation was awesome! You put a lot of thought and work into this! I definitely feel comfortable with this policy now. The outline and points you have highlighted will definitely help clear up confusion for people. Now I'm intrigued on using this policy for retirement and savings! This is awesome! Thank you so much for clearing everything up!

Feeling Lost and Unprotected When It Comes to Your Family's Future?

The Problem:

You're drowning in confusing financial jargon

Insurance agents give you conflicting information

You're worried about making costly mistakes

You feel like you're "reading a foreign language

The Solution:

Crystal-clear explanations in plain English

Expert insights from someone who works with IULs daily

Avoid the #1 mistake that costs people thousands

Finally feel confident about your financial future

The Cost of Doing Nothing:

If you don't take action, you'll continue feeling lost and frustrated. You might end up with a one-size-fits-all policy that doesn't meet your unique needs. And worst of all, you might leave your family financially vulnerable in the event of an unexpected tragedy.

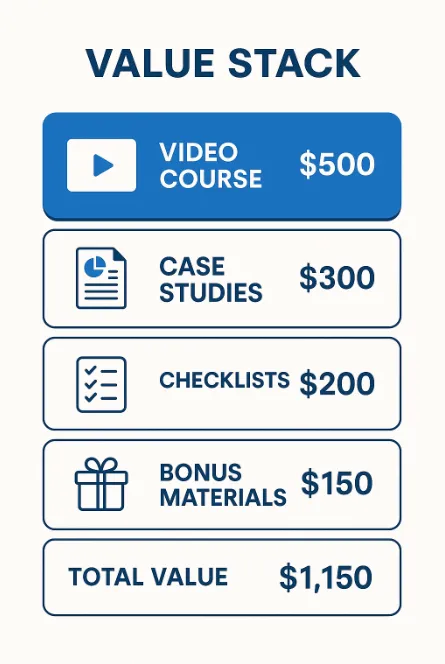

Here's Everything You're Getting Today For Just $97...

This is normally worth over $1,285, but today you get it all for a fraction of the price

Small Call to Action Headline

$497 Value

4.5 hours of expert-led video lessons that break down everything you need to know about IULs, from the basics to advanced strategies.

Real-World Case Study Library

$297 Value

See exactly how people just like you are using IULs to build wealth, protect their families, and plan for retirement. No theory, just real results.

The "Policy Wreck" Prevention Kit

$197 Value

A checklist of the top 10 mistakes people make when buying IULs, so you can avoid costly errors and ensure your policy is structured for success.

BONUS: Lifetime Access + Future Updates

$197 Value

The world of finance is always changing. You'll get lifetime access to the course and all future updates, so your knowledge is always current.

Total Value: $1,188

Your Price Today: Just $97

That's 92% OFF!

What You'll Learn Inside This Course

5 comprehensive modules that take you from confused to confident

Why is IUL So Confusing? (Clearing Up the Myths)

The biggest misconceptions that cause confusion

Why some people think IULs are a scam (and what they're missing)

The truth about IUL fees, policy costs, and market performance

What an IUL Is and What It Isn't

The difference between IUL, Whole Life, and Term Life

How cash value actually grows in an IUL

What happens if you stop paying premiums or underfund your policy

How Money Works in an IUL

The 3 moving parts of every IUL policy (and how they interact)

Interest crediting explained—caps, participation rates, and floor rates

The real costs of an IUL—and how to make sure your policy doesn't lapse

Using an IUL in Real Life

How people use IULs for tax-free retirement income

Business owners, families, and high-income earners—real case studies

How to structure an IUL for maximum benefits

Making the Right Choice for You

How to know if an IUL is the right financial tool for your goals

The #1 mistake people make when funding an IUL (and how to avoid it)

What to ask your agent before signing up for a policy

Still Have Questions? We Have Answers.

Is this course for beginners?

Absolutely! This course is designed for people with little to no insurance background. We break down complex terms into easy-to-understand concepts, so you can feel confident and in control.

I already have an IUL. Will this course still help me?

Yes! This course will help you understand your existing policy better, identify any potential red flags, and learn how to optimize it for your goals. You might even discover that your policy isn't structured correctly, and this course will give you the knowledge to fix it.

Is this course just a sales pitch for you to sell me an IUL?

Not at all. This course is 100% educational. Our goal is to empower you with the knowledge you need to make informed decisions, whether you decide to buy an IUL or not. We believe that an educated client is the best client, and we want you to feel confident in your choices.

Is this course just a sales pitch for you to sell me an IUL?

Not at all. This course is 100% educational. Our goal is to empower you with the knowledge you need to make informed decisions, whether you decide to buy an IUL or not. We believe that an educated client is the best client, and we want you to feel confident in your choices.

Don't Let Confusion Cost You Your Family's Future

Join hundreds of people who have already taken control of their financial destiny with this course.

$197

$97

Limited Time Price - Save $100 Today!

Instant Access

Unparalleled Education

Lifetime Update

⚡ This offer expires soon. Don't miss your chance to finally understand IULs and protect your family's future.

⚡ This offer expires soon.

Don't miss your chance to finally understand IULs and protect your family's future.

Secure checkout · Instant access · Lifetime Update

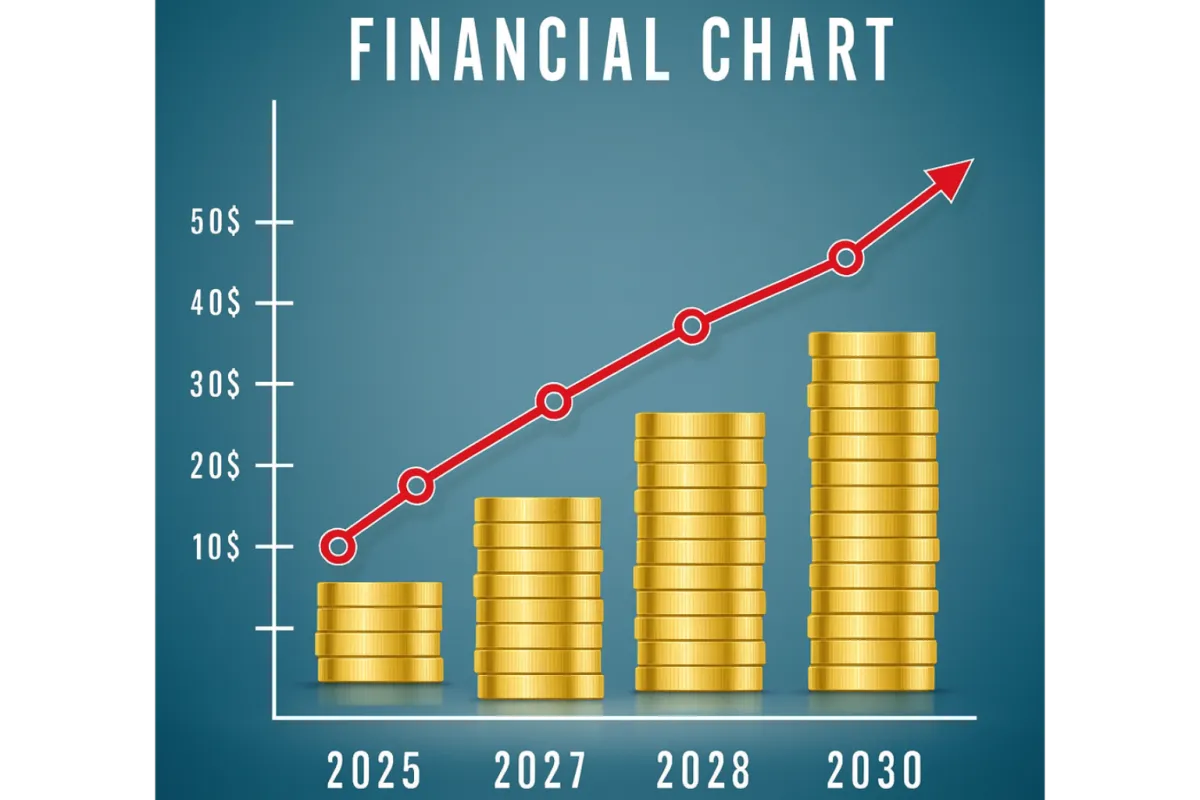

Risk-Free Growth

You can earn stock market gains without the stock market losses. Your account can never experience a loss no matter how much the stock market plummets.

Tax-Free Income

This strategy will provide tax-free income during your retirement years. Unlike "qualified" plans it will not be subject to a tax hike.

Cashflow You Can't Outlive

If set up properly, this strategy will provide income you can rely on year after year no matter how long you live.

Lets schedule a call on one page and then give access to some training material on another page.

Lets give you the highlights

Pay off all your debt in a fraction of the time with your current budget!

Access Our Course Below

Access Our Free Course Below

What this program is...

If you want to supplement your retirement with tax free income.

If you are concerned about taxation in the future.

If you don't want negative returns..

If you have maxed out qualified contributions.

If you are a business and are looking to insure key employees.

If you want to leave a legacy for your loved ones.

What this program is not...

This IS NOT a sales pitch to buy software.

This IS NOT a bi-weekly payment program or refinance.

This IS NOT an increase to your current monthly budget.

This IS NOT a mortgage modification, alteration or any other change to your current mortgage.

Copyright © 2026 Charles P. Taylor, All rights reserved. Disclosure | Terms of Service | Privacy Policy